I Refused to Use My Inheritance for My Stepchildren, and My Husband Tried to Punish Me for It.H

When it comes to handling inheritances in a marriage, things can quickly become complicated. This is especially true when one partner receives a significant sum of money, and the other feels left out or unfairly treated. A letter from one of our readers, Becky, highlights the emotional and practical conflict that can arise in such situations. She inherited a sum of money and used it in a way that sparked tension with her husband, leaving her questioning whether she made the right decision.

The Inheritance Dilemma: A Glimpse into Becky’s Situation

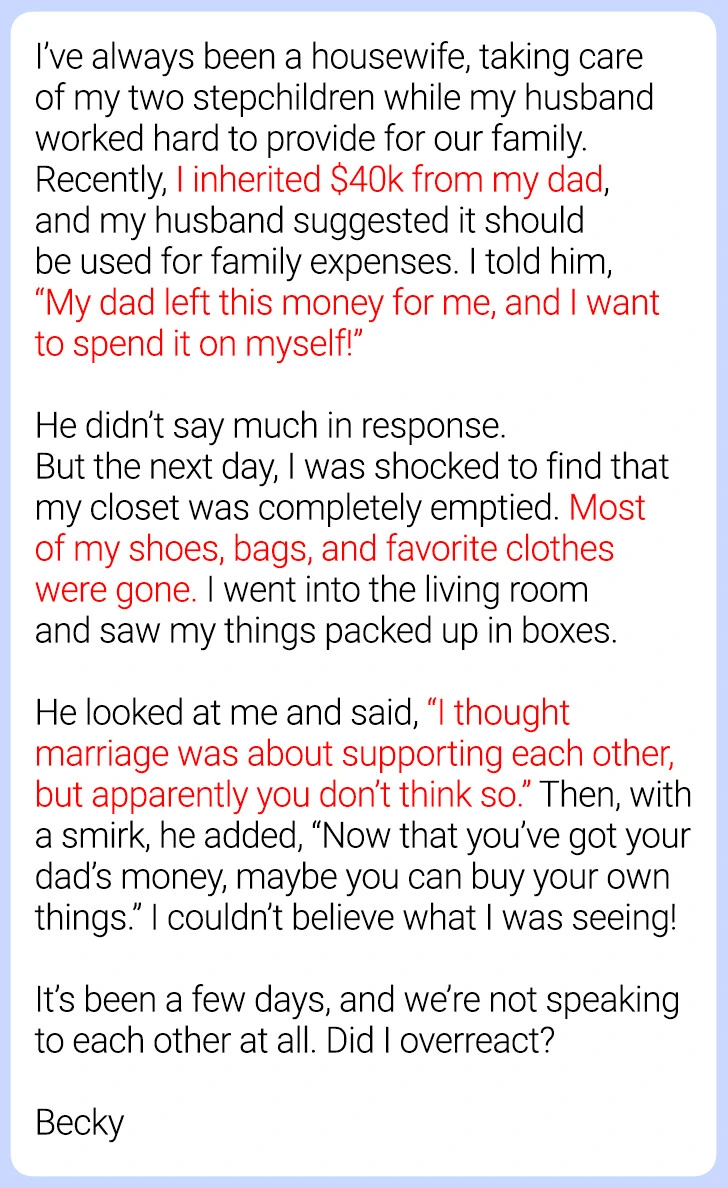

Becky’s dilemma stems from her decision to keep the inheritance for herself, leading to a rift with her husband. She had inherited a sizable amount, but instead of sharing it with him or investing in a family project, she chose to use it independently. This caused a wave of emotions and an ongoing argument in their relationship. Now, Becky finds herself at a crossroads, unsure whether her actions were justified.

Why Money Can Be a Sensitive Issue in Marriages

Money is often at the heart of marital disagreements. Couples might have different perspectives on what’s fair or how finances should be handled. In Becky’s case, the inheritance feels like a personal matter—something she might want to use to fulfill personal goals or invest in her future. On the other hand, her husband might see it as a shared resource, something that should benefit the family as a whole.

The crux of the issue isn’t just about the money itself, but about how partners perceive their contributions to the marriage and the family. One partner’s financial input might feel more visible (i.e., working outside the home), while the other’s sacrifices (e.g., taking care of children, managing the household) can be underappreciated. When inheritances come into play, these underlying tensions can surface.

Different Perspectives: What Are Others Saying?

The responses Becky received when she shared her situation with friends and family show just how divided opinions can be. Some feel that she should have communicated her intentions more clearly with her husband, perhaps seeking his input before making any major decisions with the inheritance. Others, however, believe that Becky has every right to keep the money for herself, given the dynamics of their relationship and the unspoken contribution she makes as a stay-at-home mother.

The Case for Keeping the Inheritance: A Personal Right

From one angle, Becky’s decision to keep the inheritance could be seen as a step toward personal empowerment. After all, this money was a gift to her, not something jointly owned. In a marriage, it’s not uncommon for each partner to have their personal funds or savings, and Becky could view the inheritance as an opportunity to secure her own financial future.

Moreover, Becky’s role in the family—being a stay-at-home mom and homemaker—has undoubtedly saved the family money on childcare and household help. It’s possible that Becky might feel this sacrifice has been overlooked, and the inheritance could serve as a form of compensation for all the unpaid labor she has contributed over the years.

Should Inheritance Be Shared in a Marriage?

On the other hand, some may argue that when two people are married, everything should be shared. That includes finances, especially when the inheritance is substantial. From this perspective, Becky’s husband might feel excluded or resentful, especially if he believes the money could have been used to benefit the family. If Becky’s spouse is the primary earner, he may have a sense of entitlement to the inheritance, believing it should be used for shared goals such as paying off debts or improving their home.

In a healthy marriage, it’s crucial for both partners to be on the same page when it comes to big financial decisions. Lack of communication can lead to misunderstanding and even resentment. A conversation about how to handle an inheritance is not just about the money—it’s about trust, respect, and understanding each other’s values.

The Role of Communication in Financial Decisions

The lack of a clear conversation between Becky and her husband about the inheritance is perhaps the biggest misstep in this situation. When one partner inherits money, the natural instinct might be to take some time and think about how to use it. However, the other partner may feel left out of the decision-making process, leading to feelings of betrayal or neglect. In this case, a more open discussion about their financial situation, their dreams for the future, and the potential benefits of the inheritance could have prevented some of the tension.

Had Becky explained her intentions—whether it was to invest the money in a long-term savings plan, contribute to the family’s future, or simply keep it for personal security—her husband might have better understood her perspective. Communication doesn’t always make the situation less complicated, but it can certainly reduce misunderstandings and foster a more collaborative approach to financial decisions.

Is It Time to Reevaluate the Relationship?

There’s another angle to this dilemma that deserves consideration: Is this financial disagreement a symptom of larger issues in the marriage? If the tension surrounding the inheritance is causing a significant rift, it might be worth evaluating the overall health of the relationship. While money problems are common in marriages, recurring conflicts about finances often signal deeper emotional struggles or a lack of mutual respect.

In some cases, the inheritance might not be the true issue. Instead, it could be a reflection of unresolved frustrations or unmet needs between Becky and her husband. If this is the case, it may be beneficial for them to seek couples counseling or have a more in-depth conversation about their relationship dynamics.

Moving Forward: What Can Becky Do Next?

Ultimately, Becky needs to weigh her options carefully. Should she take the inheritance and use it as a way to empower herself and secure her own future? Or should she find a way to include her husband in the decision-making process, perhaps by investing in something that benefits both of them, such as a family project or long-term savings?

One key takeaway from Becky’s situation is the importance of open communication. Financial issues can be a source of stress in any marriage, but when handled with transparency and respect, they can also serve as an opportunity for growth and understanding.

Conclusion: Balancing Personal Rights and Marital Unity

Inheriting money can be a powerful tool for personal growth, but it can also create tension when not handled properly within a marriage. Becky’s situation illustrates the importance of communication, mutual respect, and shared goals. The key to resolving such conflicts lies not in the money itself, but in how partners work together to align their financial decisions with their shared values and long-term vision for their life together.